Sustainable livelihood program for women at scale

About Digital Naari

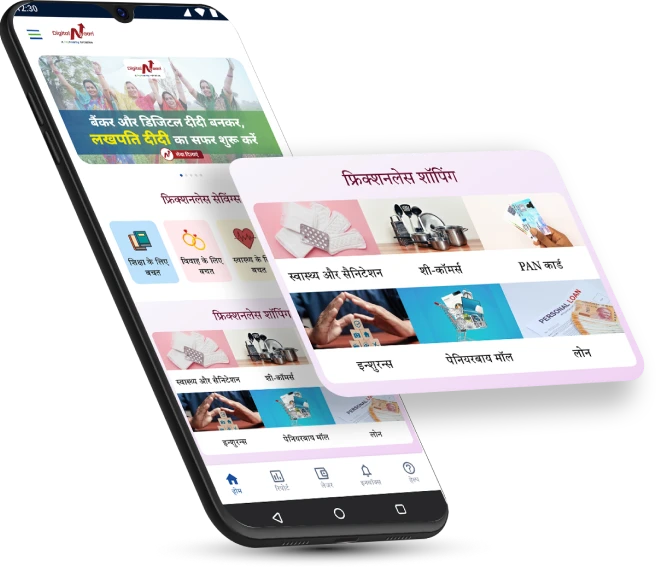

Wepaysafe’s Digital Naari Program is a self-sustaining micro-entrepreneurial ecosystem that empowers women across Bharat with a secure platform to become banking and digital Didis in their communities and ensure long-term livelihood for themselves. The program’s mission is to build grassroots community influencers who drive awareness and improve access to essential services like banking, health, sanitation, insurance, and credit for other women in their areas. In the process, the Digital Naaris ensure stable income for themselves and their families.

Currently, the initiative has over 1,50,000 registered Naaris, with a monthly average of 75,000+ active Naaris consistently transacting.

In FY 2023, the program facilitated financial inclusion services worth ₹10,000 crores. By transforming these women into community influencers through structured training, capacity building, and the use of a super app, the Digital Naari initiative empowers them to gain greater agency in their lives, support their families more effectively, and contribute to a socially impactful movement.

The goal of this program is to create 2 Crore Lakhpati Didis by 2030, supported by the Digital Naari app, who will positively impact the lives of 50 crore women across Bharat.

Why Women?

Women are the 50% untapped reserve of our nation, and by unlocking their potential, we not only enable livelihoods and give them a voice but also ensure food security, better education for children and overall better lifestyle for families. By providing flexible working opportunities, simplified tools, and continuous training, we create a supportive environment where women can thrive and earn sustainable income.

Empowers women to make their own decisions, pursue their goals, and lead a life of self-reliance.

Their involvement drives economic growth in their communities and contribute to family income.

The role offers work-hour flexibility for a better work-life balance.

Women learn valuable skills while working as women business correspondents.

They inspire others in their community to pursue similar opportunities.

Women become familiar with digital financial services and technology, thus bridging digital gap

Bridging financial divide between genders. More female business correspondents create a comfortable space for women customers, driving services to the last mile.